Martingale strategy for binary options

Probably every trader, beginner or professional, dreams of a trading strategy that would bring profit. The financial market can offer a variant, which exists practically since the XVIII century and whose efficiency is literally "time-tested". It is a Martingale strategy based on the ordinary theory of probability.

If you want to efficiently and quickly learn the martingale system, there is an interactive guide. Using the Martingale strategy in your trading on the market, you will determine the direction of price movement, find the entry and exit points and minimize the risks. As a result, you will start trading with a good profit.

The Martingale method

The martingale method gamers originally used in roulette betting. As you know, you can bet on events that involve only two outcomes, such as black or red, even/odd, and so on. Accordingly, adding a bit of probability theory here, we get the following layout: the probability of red is conditionally ½ (we don't consider zero and double zero).

Suppose we bet $1 on red, and black comes out the first time we spin the wheel. We bet again on red on the second round, but this time on $2, the probability of red falling out is ¾. If black again, on the third round, we bet $4; that is, each new game implies doubling the bet, the probability is constantly increasing. In any case, the profit in the second or the twenty-second round will be $1.

The only question is whether there will be enough money for the following position. On the player's side is maths; on the casino's side is setting your own rules, according to which there is a maximum bet; that is, putting a martingale strategy on stream, in this case, will not work.

In trading, the essence is orders are opened at some distance from each other when the price passes against the desired direction.

What is the Martingale strategy? How does the Martingale strategy work?

The martingale strategy is a popular trading methodology among traders. Almost everyone has used it to some extent or another, sometimes without even knowing that the simple action of averaging and filling a position has a separate name.

Currently, the proportion of robots that use the martingale method as the basis of their algorithm is rapidly increasing, as the methodology itself is pretty simple, and the optimization issue is to filter signals and find optimal entry points. So it is impossible to say unequivocally that the martingale strategy is a way to ruin the deposit because you can extract a lot of profits when approached correctly. But at the same time, if we look at statistics of traders' questioning about loss circumstances, most traders tell us about averaging or using colossal leverage.

However, increasing a position thoughtlessly, albeit gradually, also leads to excessive risks since there is no difference between a single order with total leverage and ten orders, each of which represents a significant part of the deposit.

The martingale strategy logic is quite simple - if the price is 100 pips below zero, breaking even will require a return of one hundred pips. If we then open one more order of the same kind, a return of 50 pips will be enough. I.e., the second-order will give us +50 points, and the minus of the first order at this point will be the same 50 that makes us zero altogether. If the price continues to move against the trader after the second order, after another 100 points, a new entrance a trader will make following the martingale method. This time it will not take 200 points but only 100 points to break even. At the same time, the slippage that has been created at this point will not be 200 pips but 300.

The further the price moves in the negative direction, the loss will increase, and at some point, it will be impossible to open a new deal due to the lack of unrestricted funds. At this point, the martingale strategy ends, and nervousness, guessing what will happen next, and pure luck begins.

It is not uncommon in the trading market to have very long trends that constantly hint at an end but invariably continue after a slight pullback. Of course, it all depends on the chosen trading instrument, but even volatile ones sometimes produce several days of solid unidirectional movement.

Martingale strategy for binary options

It's hard to imagine a trader who wouldn't dream of eliminating losses from their trading. Both professional and novice traders have these aspirations. Proper application of the Martingale method for binary options on the financial markets will make these fantasies come true. Initially, this strategy was used exclusively in gambling, namely classic roulette. The tactic is based on the theory of probability. However, the traditional Martingale strategy for binary options has been adapted over the years, and today its variations are successfully used in trading.

The use of Martingale tactics has been heavily criticized. This is because novice traders using this strategy have repeatedly lost their investments due to inexperience and insufficient training.

The benefits of the Martingale strategy

The market moves and lives, regularly changing its direction. To predict its movement in the future is a tough task for a trader. When trading using the Martingale strategy, a trader's number of open trades can be limited only by their deposit volume. Simultaneously, if he did not guess the market direction when opening trades, one price pullback can bring him a profit, compensating for all these losses. This is the main advantage of the Martingale strategy. There is no concept of total "currency depreciation" in the financial market. Although, the long-term operation of this system is not recommended.

So, from all of the above, the following conclusions can be made about the advantages of trading with Martingale:

1. Entry by trend:

- By entering the market on the trend at a small bet, the trader can take the planned profit;

- When a trend suddenly breaks in the direction of its current movement, the trader's chances of making a good profit are significantly increased;

- If the trend breaks in the opposite direction, the Martingale strategy allows him to wait out the pullback to stay in profit or close the trade without making a loss.

2. Entering against the trend:

- When trading against a trend with a minimum lot (for example, $0.01 or $0.001), the trader also has the opportunity to wait for the market to reverse and exit with a profit;

- If the price slump is too deep, the trader may close with a zero profit, and then his trade will not be considered loss-making.

3. Profit on interest rates:

- A Martingale strategy for binary options allows one to profit on interest rate differentials, offsetting losses through interest income. In this case, a trader needs to trade currency pairs in the direction that will provide him with a positive swap. Hence, it will be a guarantee of getting profit on the deposit.

- To buy a currency pair, one should choose the currency with a high interest rate and sell it with the lowest interest rate. The profit will be higher if you open several lots at once according to this principle.

4. Combinability:

The Martingale system for binary options can be used as an independent system but does not prohibit the trader from using other trading strategies at the same time:

- As a standalone method, it does not require the trader to use any algorithms or specific skills;

- As a complementary system, it increases the likelihood of more profits significantly, but also the trader must have particular skills.

The Martingale system for binary options does not attract professional traders; they sometimes use it as an auxiliary method in its pure form. For instance, professionals often use Martingale in conjunction with one of their effective trading strategies.

The Risks of Martingale Strategy

When calculating the desired profit and the minimum bet amount, a trader should control their "appetite". Greed will kill even the best intentions - remember that! Unluckily, practice shows that this trading system often "eats up" the deposit, mainly if inexperienced traders use it for a long time. It is not just because Martingale is considered one of the most progressive and dangerous strategies.

It seems to a beginner trader to be ideal and straightforward for making easy profits. If he has a substantial deposit and complies with all conditions of this method, he can count on profitable deals. Otherwise, his deposit will quickly melt away. Thus, the Martingale strategy can both enrich and ruin the trader.

To reduce the pressure on the deposit, traders resort to various tricks and techniques:

- When winning each successive trade, they increase the bet by the odds not by a factor of 2, but by a factor of less;

- After a series of unsuccessful trades, they change their aim (refuse to take profit and close with "nothing");

- If an unsuccessful entry into the market or trade goes against the trend, do not open new transactions until the unsuccessful open positions are closed without loss.

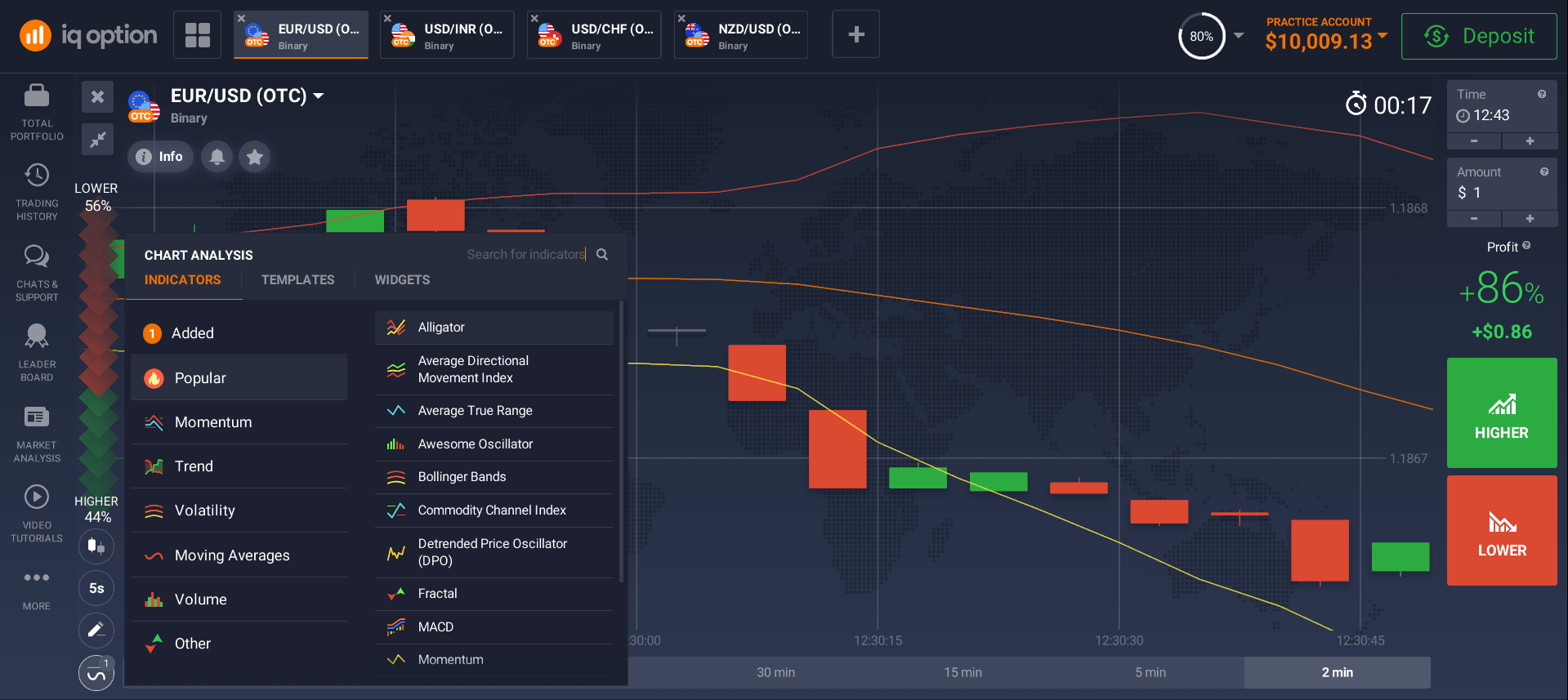

How to use the martingale strategy in binary options?

When trading on binary options, the same principle of the strategy can be applied. If you close the trade with a loss, you need to double your initial investment and buy a new option in the same direction. You should proceed in the same manner until the order closes in profit. The profit will compensate for all the losses and even bring in a net gain.

However, high profits will require setting the period of expiration from a few minutes to 1 hour. Furthermore, because it will be necessary to increase the investment amount in case of failure exponentially, the value of the first option should not be more than 1% of the total capital. Therefore, you will have to make at least ten successful trades a day to generate measurable profits.

Binary options and financial markets, in general, have their peculiarities. For example, long movements of the price chart in one direction are possible and frequent.

If you use the Martingale tactic in its pure form, the result is a high risk of losing the invested funds in 1 trading day. That is why this strategy should be used only in combination with technical or fundamental analysis. The primary purpose of the Martingale strategy is to allow the trader to compensate for losses quickly and reach the planned profit.

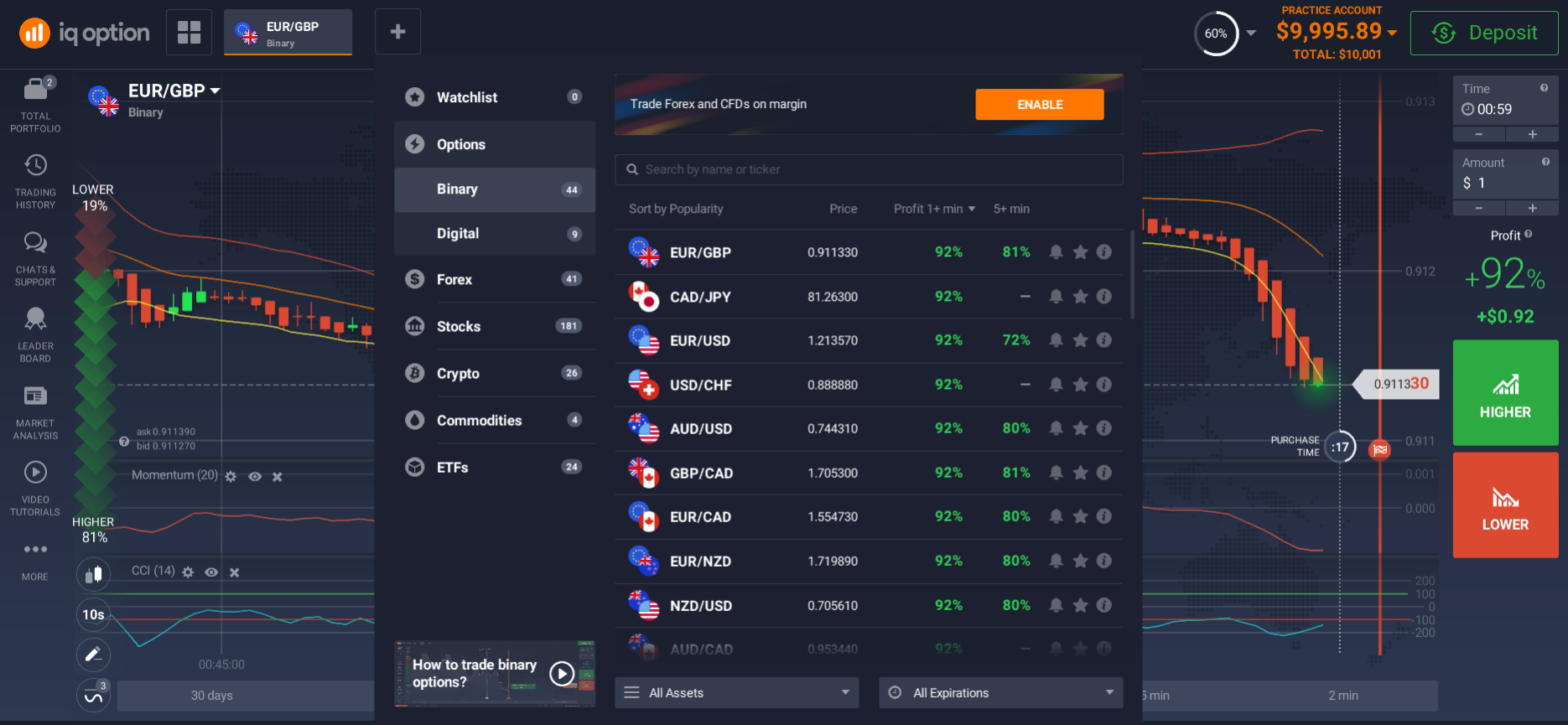

The main advantage of the Martingale tactics is its universality. The strategy can be used on any interval chart as well as on any asset. However, you should pay attention to flat currency pairs for practical use of the system:

- EUR/GBP;

- EUR/NZD;

- AUD/NZD.

According to Martingale, these trading instruments differ from their counterparts because they spend 90% of the time in a sideways movement, i.e. descending candles alternate with ascending ones, which creates the most favourable conditions for stable earnings.

What is the best way to deploy the Martingale strategy in binary options

Martingale tactics are viral among traders. It is most advisable to use it on currency market assets because they differ from securities and commodities by high liquidity and significant volatility. These are the best conditions to maximize profit. Today traders' arsenal includes several options for the successful application of the Martingale TS, which beginners should familiarize themselves with.

- Classical strategy.

The simplest way to apply the Martingale probability theory is to earn money on binary options in practice. You should double the amount of your first investment on a losing trade and open a trade in the same direction. Repeat the doubling about to make a profit. It is essential to understand that this simplicity hides high risks. That is why it is recommended to use this strategy only in combination with oscillators or other effective trading systems. The primary condition for successful trading is the low cost of the first option. It is essential to be able to sustain 7-9 losing trades in a row.

- Applying Fibonacci numbers.

Using the Martingale method for binary options involves high risks. Applying Fibonacci numbers will allow reducing potential losses; however, in this case, a trader will lose income in making a profitable trade but keep the part of the deposit he has lost. The Fibonacci formula is used to calculate the number of repeated investments. If the classical version of the strategy implies doubling the initial investment, in this case, it will be necessary to increase the initial investment according to the principle of the Italian mathematician, i.e.:

- 1 trade = $1;

- 2= 1+1=2$;

- 3= 1+2=3$;

- 4=2+3=5$;

- 5=3+5=8$ and so on.

Thus, the Martingale method for binary options can be applied in practice with small initial capital. However, one should pay attention to the fact that this method is not aimed at gaining profit but rather at diversifying risks. It is also important to remember that the average return on the classic options ranges from 67% to 85%, depending on the broker's conditions, which is a very negative factor when working with the doubling method.

- Anti-martingale strategy

This version of the practical application of Martingale theory in binary options trading is radically different from the others. According to its rules, you should open an order with double the investment amount if the first option turns out to be profitable.

The objective is to identify the correct trend and make maximum profit on the movement of the price chart. Using this tactic to trade will allow you to increase the deposit to the valid values relatively quickly.

How to start using the Martingale strategy in Malaysia?

Now you know what a matrilineal strategy for binary options is. It's essential to start trading with a reliable broker.

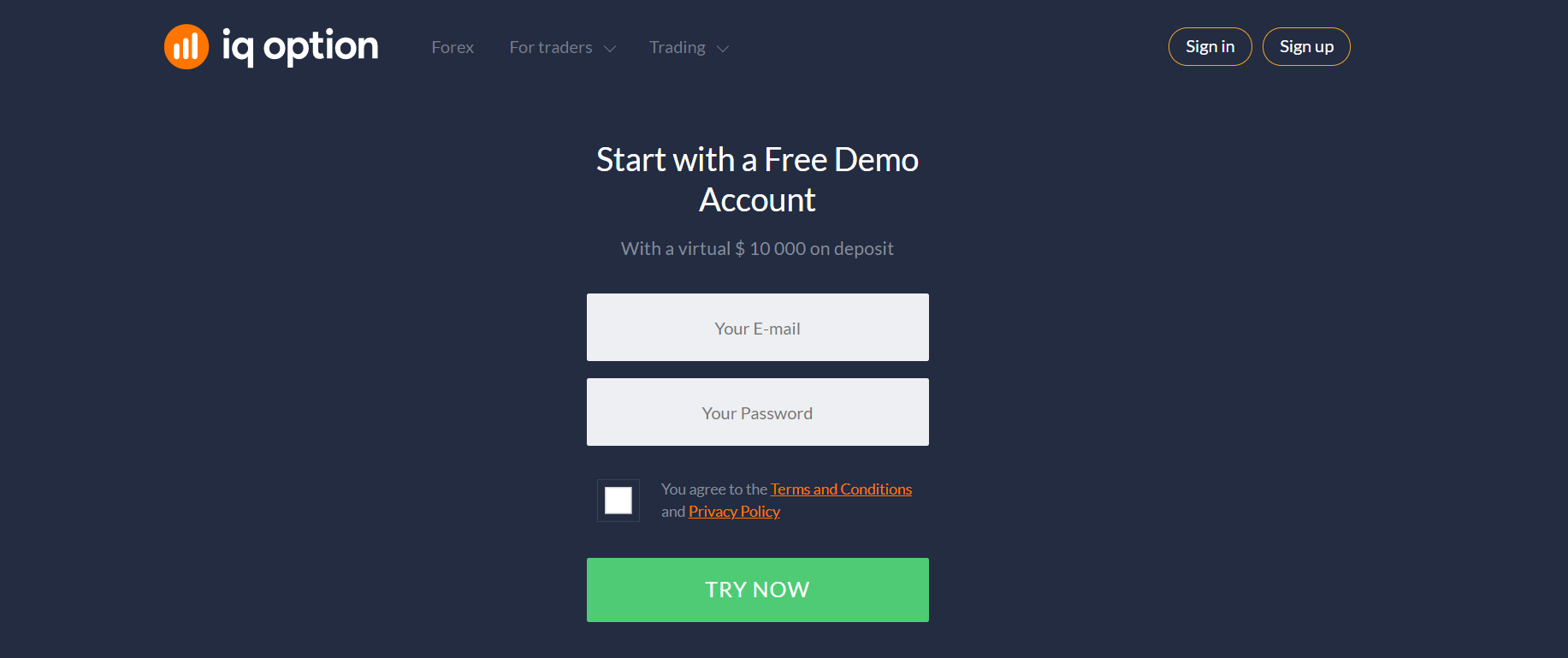

How to register?

When you have found a reliable broker, register online. The process does not take long. You have to enter some personal information, so the platform can identify you.

How to open a demo account?

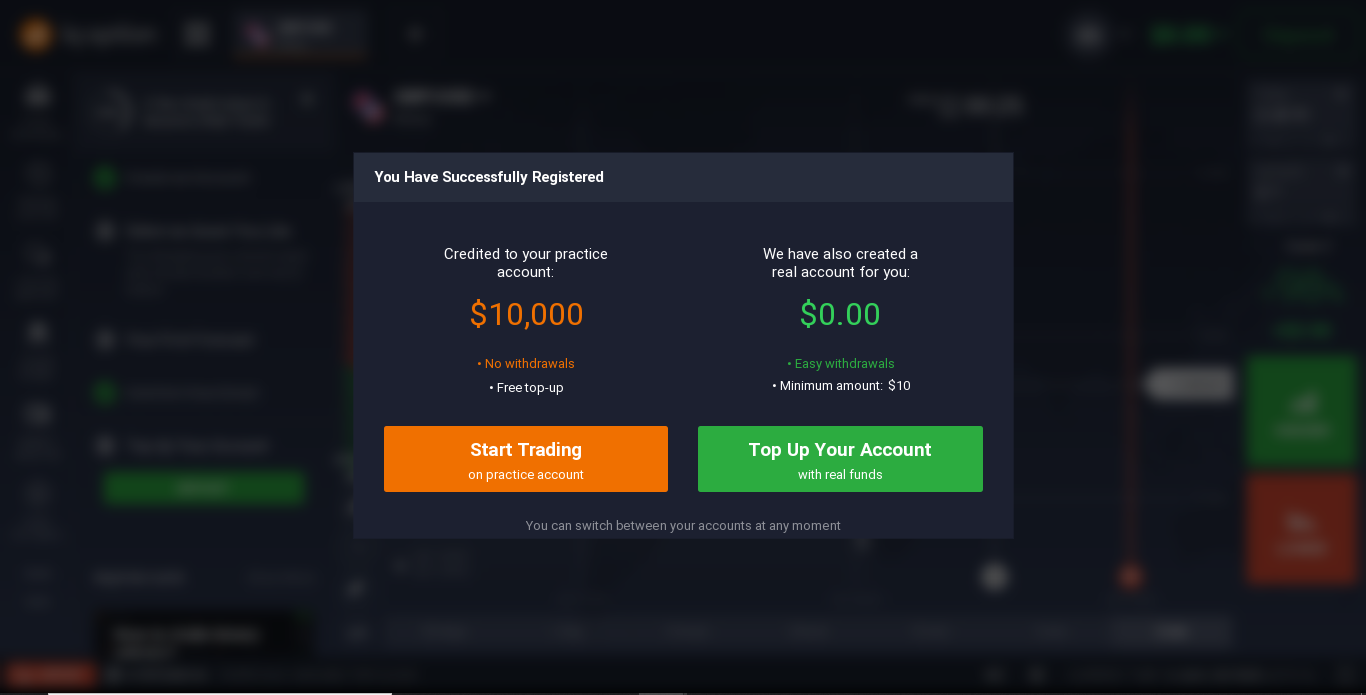

To minimise the risks at the initial stage, be sure to use a demo account. Then, you will test different strategies, experiment and study the platform itself and the indicators. In this way, you will get a better idea of the trading process without any monetary losses.

How to open a real account?

When you feel ready to invest, you will be able to open a real account. To do this, you will need to make a deposit. Usually, the minimum deposit starts at $10.

Now that you know the martingale strategies for binary options, you can start practising.