Forex trading in Malaysia

For those who are late to the party, Forex trading is a genuine way to build a steady income. Whether you are a seasoned trader or want to enter the world of foreign exchange, you have visited the right place.

We will dive into the world of forex trading and take a detailed look at everything related to it. The good news for Malaysians is that they can indulge in forex trading through an approved and registered institution. Read further to know more about forex trading in Malaysia and how to start it.

What is forex trading?

Forex trading involves trading an international currency for another one, and all such transactions take place at a forex market. The market has an exchange rate for all currencies, and they are listed in currency pairs like INR/USD, AUD/GBP, etc. Billions of dollars are traded every day in the liquid forex market.

The forex market does not have a land-based location and is a network of brokers, banks, financial institutions, etc. Trading does not involve physically exchanging money, but you do sell or buy foreign currency. People buy foreign currencies hoping that their value increases over time and bring them profits.

Currency pairs

Each trade and transaction in the forex trade involve the sale and purchase of two currencies simultaneously. You sell one currency and buy another, so a currency pair has a quote and a base currency.

A pair’s price is how much quote currency you need to buy the base currency’s one unit. Base currency is on the left and is worth a single unit. It is sold or bought for the quote currency. Major currency pairs dominate 80% of forex trade but exotic and cross currency pairs are there too.

Cross-currency pairs do not have the US Dollar. Earlier, you had to convert the pair into the desired currency and USD, but cross currency pairs are available for direct forex trade now.

Types of forex trading analysis?

You can predict forex market movements live positions and, you have to use either technical or fundamental analysis. Traders may also use both these techniques together.

1. Fundamental Analysis: This analysis involves a study of various factors that affect the market and how the market reacts to them. Social and political factors, market sentiments, country’s financial position, etc., have effects on the forex market.

2. Technical Analysis: This method involves analysis of price changes and other trends in the market. You can guess market demand and supply and price changes through this. Know the right time to trade and at the right price level.

A List of main technical indicators for Forex

Technical indicators will help you analyze the forex market in a better and detailed manner. You can analyze price movements, trends, averages, etc.

- Trend Indicators: A trend is your friend, and these indicators will help you recognize the currency pairs that are trending up or down. ADX, Ichimoku, Moving Average, etc., are some common trend indicators.

- Oscillator Indicator: It helps analyze momentum of a particular currency pair and the speed with which the price level changes. You can use this information for a price chart and plan your steps accordingly. CCI, RSI, Stochastics, etc., are some examples.

- Volatility Indicator: If the price of a currency pair changes very fast, it has high volatility. If price fluctuations are low, then a currency pair has low volatility. You should know how volatile a pair is before trading. Bollinger Bands, ATR, etc., are common volatility indicators.

- Bear and Bull Market: A bull market signifies that the price of a currency pair has been increasing over a long period for various reasons. A bear market shows that the price of a currency pair is going down by 20% each quarter on a trading platform.

Basic Forex Trading strategies?

You should never trade without prior knowledge and research. A good trader always makes a proper strategy and analyses the market before buying or selling currencies. Everyone has a different way of trading.

Here are some basic strategies to make money through forex trading:

1. Forex Day Trading: One of the most popular strategies, day trading involves the sale and purchase of currencies on the same day. You cannot hold a position overnight, and professionals prefer this strategy. Recently, beginners have also started using day trading through online platforms.

2. Position Trading: In a trading position, you buy-and-hold a position and use weekly or monthly charts to know market trends and price changes. Position trading can last for weeks and even months. Traders look to jump on established trends and usually exit a position when a trend ends. Position trading is difficult in highly volatile forex markets.

3. Scalping: A quick general active trading strategy in which you have to identify and exploit bid-ask spreads. An imbalance in demand and supply makes the spreads narrower or wider than usual. Scalpers make small transactions and make low profit per trade. This strategy works nicely in markets without sudden price changes.

4. Swing Trading: Price volatility is high when a trend ends, and a new one is trying to establish. Swing trading involves trading when the price volatility starts gaining steam. Swing trading is shorter than trend trading, but it does take more than a single day. Make a fundamental or technical analysis before using swing trading for top profits fast.

How to start Forex trading in Malaysia?

The official law in Malaysia states that you can trade forex in the country through an approved and registered organization. There are multiple legal brokers in Malaysia where you can trade. You can even trade at offshore brokers, and it is considered foreign investment.

You will find multiple online exchanges that offer forex trading through multiple payment options. You can register at a reliable and trustworthy broker to carry forward with trading. Whether you plan on short term trading or long-term trading, you should have a proper trading plan in place.

It will be easy to take profit and stop loss if you have proper knowledge and prior experience in the forex market. Knowledge of orders should be a priority if you want to indulge in trading.

Market & Limit Orders

Market orders imply the sale and purchase of a foreign currency at the current price. Buy orders mean immediate purchase of a currency at a price around posted ask. Sell orders mean selling a currency at a price around posted bid.

Limit orders or pending orders allow you to buy and sell currency in the future at a particular price. These orders are of 4 types:

- Buy Limit: Order to purchase a currency at or lower than a specific price. Place this order below the market price and on the correct side of the forex market.

- Sell Limit: Place the limit order above the market price and sell a currency above or at a specific price.

- Sell Stop: Use this order to sell currency below the current market price.

- Buy Stop: Use buy stop to buy currency at a price higher than the current market price.

Spot & Strike price

The spot price is the current market price of a particular currency that can be purchased or sold.

Strike Price is the fixed value of a currency that will be traded at this price on a future date.

During trading time, it is vital to know of all this if you want to make profits through forex. Huge financial risk is involved in trading and having prior knowledge is a good thing for proper financial management.

A good broker will help you with everything related to forex trading at affordable rates. Here is how to find a broker and start trading.

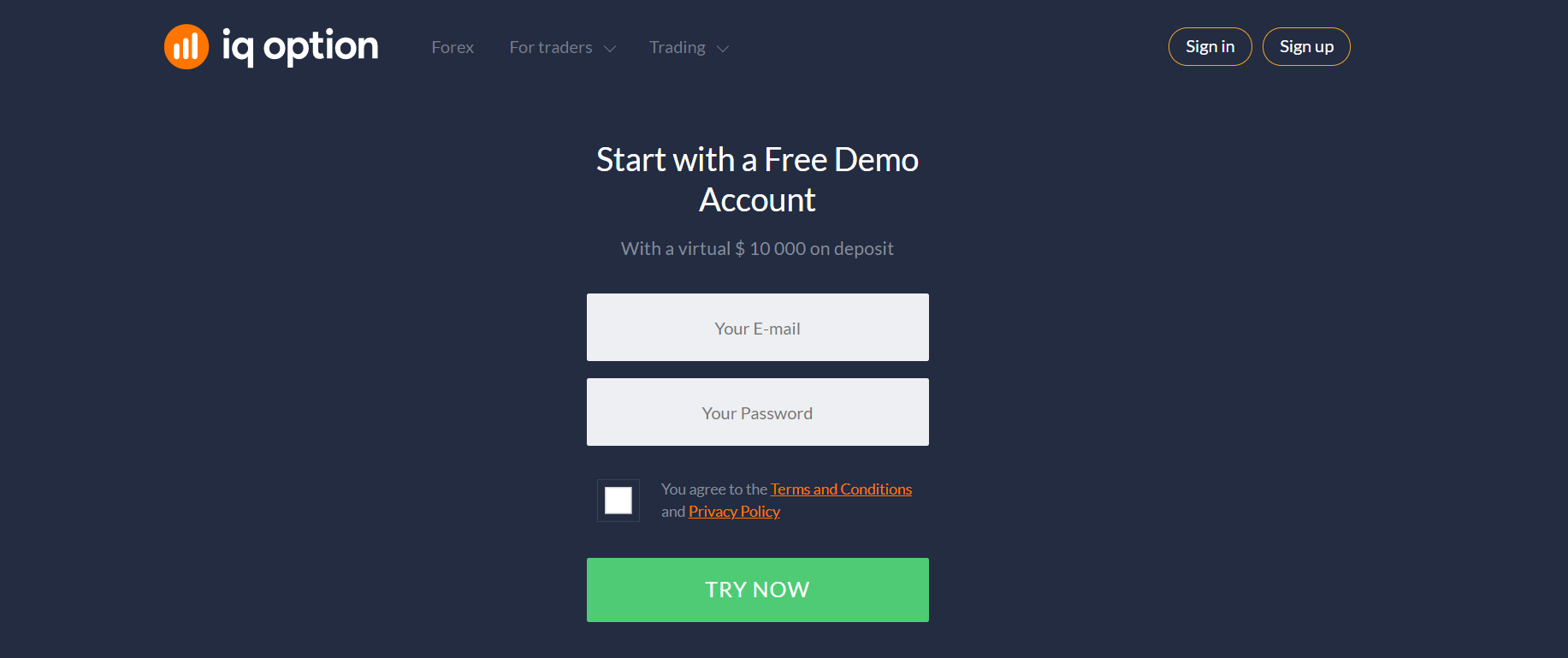

How to register?

For those who want to participate in forex trading in Malaysia, the first step will be choosing a reliable and licensed broker and making a trading account there.

- Visit the official website of the broker;

- Click on Register or Sign Up to begin the registration process;

- Use your e-mail account and create a strong password;

- Read all terms and conditions and Privacy Policy thoroughly;

- Finish the registration process, and your trading account will be setup.

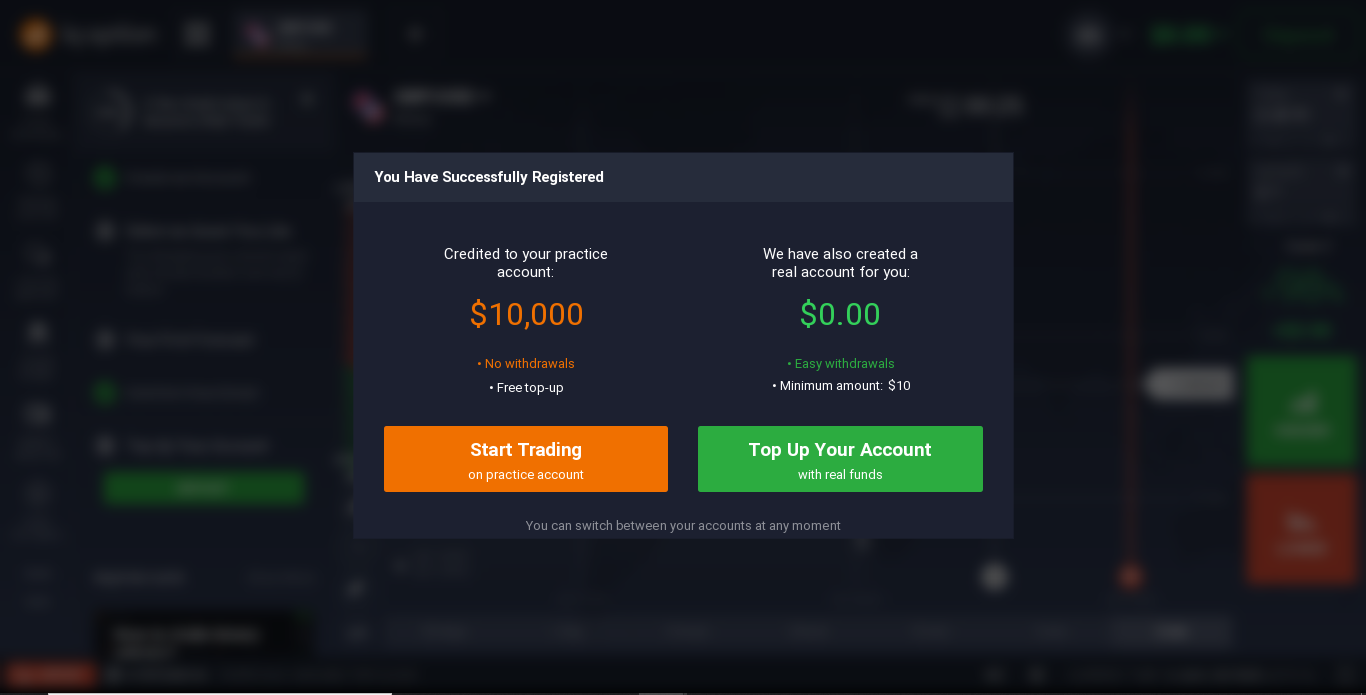

Once your account is up and running, it is easy to take a free trial with virtual money. You can convert your account into a real one through the verification process.

How to open a demo account?

Almost all the best brokers and online exchanges will offer a free demo to users before spending real money. You will see a Try Now button on the website to take a demo first.

- Click on Sign Up on the exchange website’s homepage;

- Use your e-mail ID and create a strong password;

- Click Try Now to make a demo account first.

An email will be sent to you with a confirmation link. Click on this link to verify the registration process, and your demo account will be ready to use. The demo account is free and does not require you to spend money.

How to open a real account?

A demo account is good if you are new to forex trading, but it does not have all features of a real forex broker website. You can take a look at trading options and practice without money. When you want to use real money and buy or purchase currency, you will need a real account.

- Open the broker’s website and login to your demo account.

- Open Profile and click on Verification.

- Verify your e-mail address using the confirmation link if you haven’t done it already.

- Verify your identity by providing details like name, address, phone number, etc.

- Upload documents to prove your personal details and finish the verification.

Once you have done all this, your account will be verified and ready to use. Add money to your account and use it to buy and sell foreign currencies on the online exchange.

How to replenish a deposit?

Follow these steps to deposit money into your trading account easily.

- Login to your account and then press the Deposit button.

- Choose any one of the payment methods accepted by the broker. Debit/Credit cards, Neteller, Skrill, etc. can be used to add money.

- Enter the amount you wish to deposit into your account and complete the deposit.

The money you deposit into your account can be used to buy or sell foreign currencies.

Minimum deposit amount

The minimum deposit amount varies on most brokers and online exchanges, but in most cases, the minimum amount is $10. You should go through terms and conditions to check out the minimum deposit limit.

Most brokers don’t charge for making deposits, but in some cases, you may need to pay a small charge for money transfer or currency conversion.

How to withdraw money?

You can withdraw money from your trading account easily, just like you make a deposit.

- Login to your account and press Withdraw to start the process.

- Click on your preferred payment method from credit/debit cards, E-Wallets, bank transfers, etc.

- Enter the amount you wish to withdraw and complete the verification process.

- Your funds will reach you soon but the time varies based on your preferred payment method.

FAQs

What is the best time frame for forex?

The best time frame for forex depends on your chosen trading technique. Each trader uses a different time frame. Position trading, swing trading, and day trading time frames are the most used by traders.

Can you trade forex at night?

Yes, you can trade forex at night because forex markets are active 24*7. The market is not centralized, and people from various parts of the world trade all day whenever they want to.

Which forex indicators are the most profitable?

Pattern recognition indicators, moving average, Bollinger Bands, MACD, and Relative Strength Index are the most profitable forex indicators.

What types of trades are the most profitable?

For those who want to trade over a short time period, Day-trading and scalping are profitable. For long-term trading, swing and position trading will be more profitable.

What is a Pip in forex?

Price interest point or percentage in point is a pip in forex. It indicates the exchange rate’s smallest price change based on market convention. Currency pairs have 4 decimal places, and pip is usually the last one.

How do you predict trends in forex?

You can use moving average indicators, momentum, or support and resistance to predict trends in forex.

How do you check trends in forex?

The best way to check or identify a trend is through the price change. Uptrend or bullish, horizontal trend or flat, downtrend or bearish are used commonly.

Which chart is best for trading?

For trading, you can utilize a tick chart to check out possible trade opportunities and other related information and data about the market.

Can I trade forex with $ 10?

Yes, most online exchanges and forex brokers allow users to deposit a minimum of 10$ and start trading forex.