Day trading platform in Malaysia

What is day trading? Day trading is a trading style in which buying and selling financial assets is done in one day. Day traders do not leave open positions overnight. They close the current position at the end of the day and start a new trade the next day. Typically, day traders diversify their profits by buying and selling multiple assets (stocks, bonds, commodities) on the same day, trying to profit from small market fluctuations. Successful day trading presupposes concentrated participation in the process and full return, active trading throughout the day. It also requires a special mindset. Day trading requires quick decisions and you have to calculate small profits over and over again. While the general investment strategy is to profit from long-term price fluctuations, day trading is considered to be the opposite.

All operations are performed by a day trader through an online trading platform, so choosing a platform is one of the main tasks of a trader.

We looked at different platforms and chose the best in our opinion online trading platform for day trading in Malaysia.

Day Trading: Features, Advantages and Disadvantages

As mentioned above, day trading is a type of short-term trading, when all transactions are opened and closed on the same day, without carrying over to the next trading day.

One of the reasons for the popularity of this type of trading is that it is financially efficient and you can invest even with a small amount of money. This fundraising efficiency is largely due to "cyclical trading (daily trading)", which leverages cash trading and margin trading effectively. Cycle trading is a physical trading method in which the same funds are used to trade multiple times when stocks change.

Day trading does not involve “overnight risk” as the position is not carried over to the next day and you can trade with most of the risk limited by fluctuations in stock prices.

“Overnight (carry-over) risk” is the risk that arises when the price of a share is carried over to the next day. The risk of falling stock prices experienced by many investors. Day trading, which completes the order to settlement process during the trading hours of the day, has the advantage of being unaffected by internal and external economic indicators and corporate indicators announced after the close of such trades. In other words, day trading allows you to trade most of the risk by focusing only on the fluctuations in the stock price. On the other hand, in the case of medium-term and long-term investments, the longer the period of holding shares, the higher the impact and risk on stock prices, such as the risk of fluctuations in interest rates and exchange rates, as well as the risk of company bankruptcy, the impact of internal and external economic indicators.

However, day trading has its drawbacks. Firstly, you will have to make a fairly large number of trades, since short-term trades with small capital will not bring much profit and the day trader compensates for this deficiency with the number of trades. Accordingly, it takes a lot of effort. Secondly, the day trading market is very dynamic, the situation can sometimes change in a matter of minutes, so a day trader must be constantly involved in the process, collected, active and attentive. Here, in addition to knowledge and professionalism, the personal qualities of a trader are also important.

Another disadvantage of day trading is the presence of significant commission costs. It is important here to correctly calculate the ratio of the possible benefits from the operation and the costs incurred.

Day Trading Strategies

There are several methods to profit from day trading. Each trader chooses his own trading strategy based on his risk tolerance and current market conditions. Traders can rely on a variety of strategies to quickly adapt to rapidly changing market conditions.

Below are some of the most popular day trading strategies:

- Scalping.This is one of the most popular day trading strategies that aims to minimize losses, but also attain minimal profits. The strategy is to close the trade as soon as it shows a small profit. Scalping trades can be held for only a few minutes or even a few seconds.

- Impulse.Momentum Investing is an investment strategy aimed at buying uptrending stocks or short selling stocks, which are a measure of the strength or acceleration of a stock's price trend. For example, a positive press release can trigger a surge in prices that will last for a period of time. A day trader anticipating such a move could buy a security and try to sell it at a profit after the price has risen sharply.

- Opposite trade.Opposite trading is based on the idea that a security whose price has been steadily rising or falling for some time needs to be corrected. With the opposite strategy, the day trader will look for signs of an imminent reversal of the price direction and act accordingly.

Financial Markets for Day Trading

There are many financial markets that offer day trading opportunities. Each market has its own dynamics and it will take time to learn and understand the pros and cons of each market.

The choice of the financial market depends on the preference of the trader himself, as well as on the financial capabilities.

The trading platform we have chosen provides the opportunity to trade on the following markets that are popular among day traders today:

- Foreign exchange market (Forex) - is the most liquid financial market in the world and requires the least amount of capital to start trading. The platform offers the ability to trade 25 pairs of popular currency pairs, leverage up to 1: 1000, minimum investment of only $ 1;

- Futures markets - it takes more money than the foreign exchange market to open a trading position, but less than the stock market. In futures contracts, an underlying asset, such as a commodity or stock index, is bought or sold;

- Stock markets - they are more capital intensive. On the platform, you will find stocks of 180 large companies, a leverage of 1:20 and the possibility of a minimum investment of $ 1;

- A commodity market in which commodities such as oil, precious metals and industrial metals are traded. Here the leverage is up to 1: 100. The minimum starting capital is also $ 1.

A wide selection of popular financial markets, minimum investment amount and leverage options attract day traders to choose our platform.

Day Trading Platform

Dynamics, speed of decision-making, concentration are the main qualities of a day trader. But, if the trading platform is not flexible enough in its settings, operations take a long time, there are no specific instruments for trading, there is no access to the necessary financial markets, then the trader's work will come down to zero success rates. Therefore, one of the main tasks of a day trader is to choose a good online trading platform. It is important to take into account such points as ease of registration, a convenient and intuitive interface, the availability of the necessary tools for trading, information content, and so on. Consider these features in detail below.

Registration

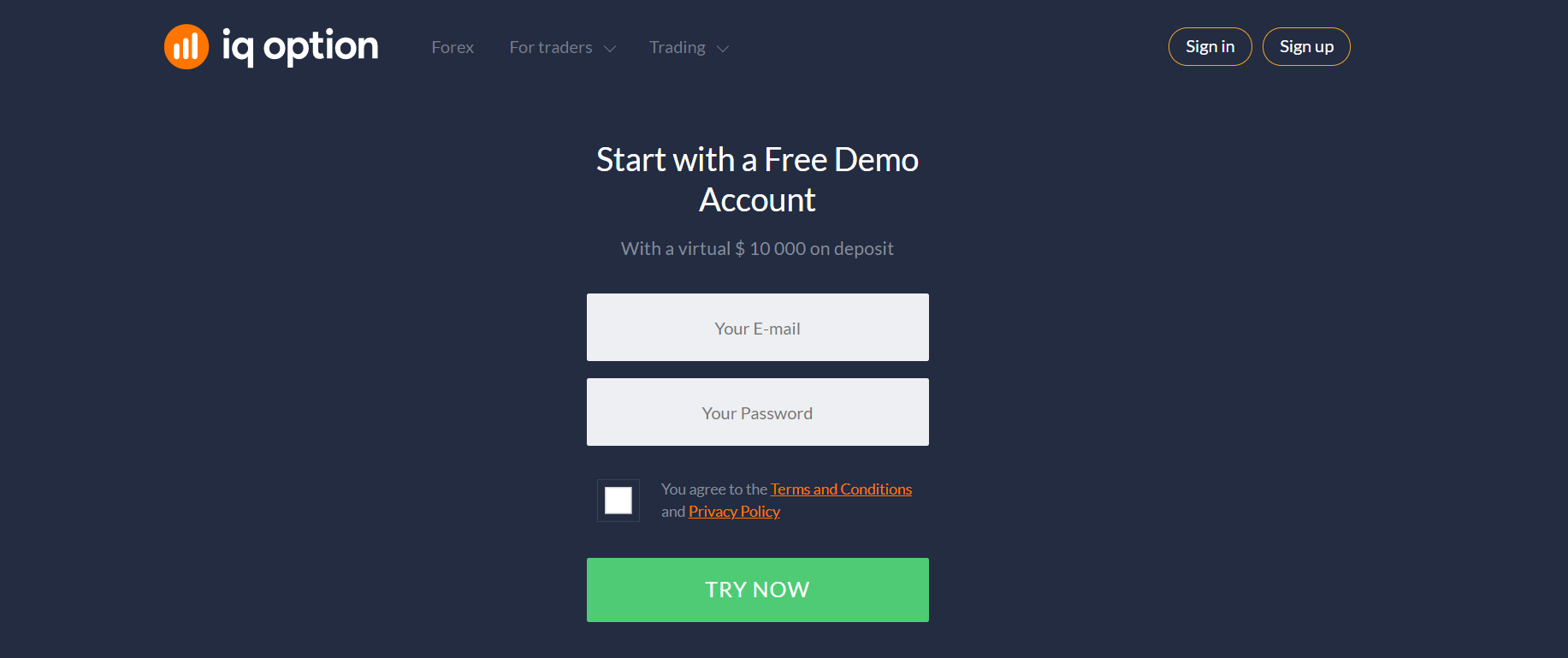

Registration on the platform should be simple and straightforward so as not to discourage a potential trader from starting trading. It is extremely easy to register on the trading platform of our choice, since there is a standard registration option, using e-mail, and you can also use the possibility of registering using a social network. In the first case, enter your valid email address in the registration form, enter your username and click "register". The system will immediately send you a verification link to the specified mail to confirm registration - follow this link, as indicated in the accompanying letter, and thus confirm your account. That's all. The second way of registration is even easier - just select the button "use an account from a social network" below the registration form and select the icon of the desired social network. All data will be automatically copied from this network to your account.

Demo account

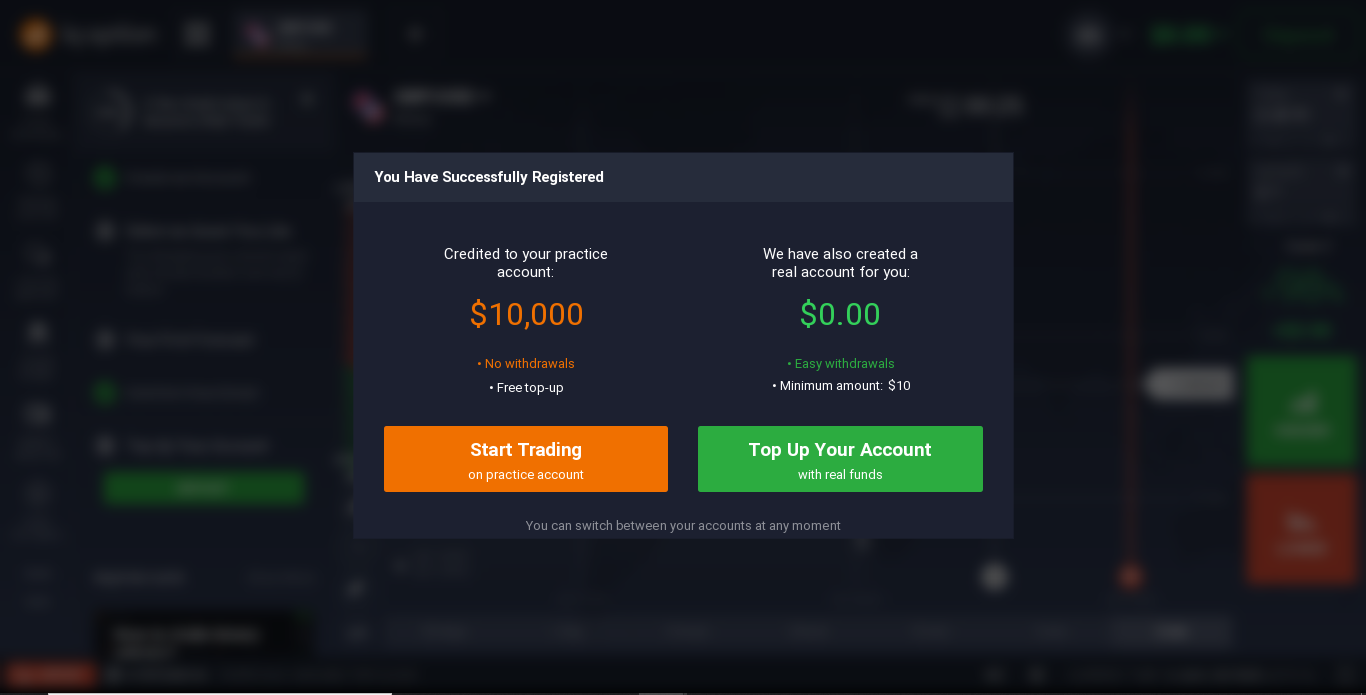

Advanced modern platforms offer a demo account for beginners to practice trading without risking their money. What is a demo account? This is a training version of a real account, to which the system credits fictitious funds for trial operations. Our chosen platform offers a demo account with a fictitious amount of $ 10,000, which is not limited in time of use. In addition, the balance of this account can be replenished as many times as you need.

Account replenishment and withdrawal

A real account is activated by replenishing it with real funds. Our platform pleases with a loyal (low) amount of the minimum deposit limit of $ 10, as well as the ability to replenish an account directly from the platform interface by simply clicking the "deposit" option and choosing the deposit option. Top-up options include a bank payment card or one of the payment systems of your choice. Funds are credited to the account instantly, there is no commission for replenishing the platform.

With the help of the same payment instruments, you can also withdraw your funds. In this case, the minimum withdrawal amount is $ 2!

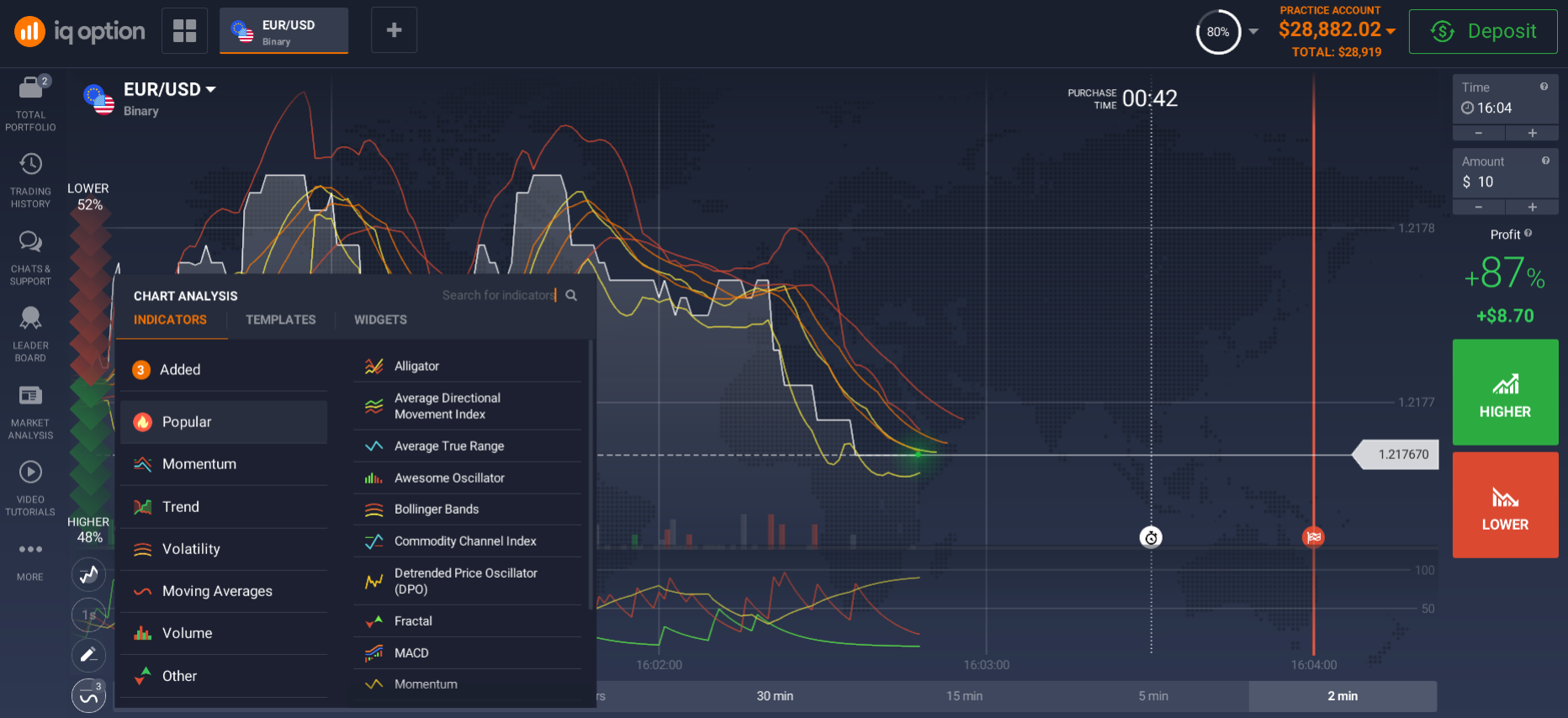

Trading instruments

The trading platform is convenient for trading tools such as stop orders, multiplier, as well as analysis tools such as news feed and indicators for technical analysis. Thanks to these functions of the platform, a day trader has the opportunity to better control his operations, to secure them as much as possible, to analyze possible market trends.

Stop orders

Stop orders, known as stop loss and take profit, make it possible to set a limit on operations, upon reaching which the position will automatically close. Stop loss allows you to set the price reduction limit, take profit - the profit limit. This helps to capture instant market changes and not miss the moment. For day trading, these functions are especially important, since sometimes even a few seconds are important here - a trader at this time may be distracted from the monitor or simply not have time to react to price fluctuations. Practice on a demo account how to set stop orders correctly and use them to reduce the risk of transactions.

Indicators

As a trader, you can also sometimes use fundamental analysis to make profits in your day trading. This also applies to technical analysis.

Fundamental analysis is based on the study of the company's activities and historical processes that have influenced or are affecting the value of an asset. It is important to have up-to-date information here.

You can trade stocks based on news from individual companies. For example, you can wait for company reports and try to take a position in the direction in which the stock will move after the report is released. The day trading platform that we are considering is very convenient, as it has a built-in news feed, with the help of which we see all the relevant news that have an impact on the asset of interest to us.

But still more often in day trading, traders use technical analysis methods.

Technical analysis includes the analysis of market price patterns. When a day trader sees a clear pattern, it means that price is more likely to go one way than the other.

Many patterns can be used by both day traders and those who base their trading on longer time frames. Day traders who specialize in technical analysis make trades lasting from a few seconds to a full day.Here the platform offers indicators for technical analysis. On the platform we are considering, almost all known indicators are collected, with the help of which day traders will be able to draw up a clear and understandable picture for analysis.

How to start day trading?

If you want to start day trading, first check the following points:

- Choose a decent broker by researching the brokerage market. Remember, a broker must have an appropriate license to engage in brokerage. Also read the reviews of experienced traders about this broker;

- Register on the online trading platform;

- Explore the platform using a demo account;

- Choose a financial market, taking into account your personal preferences and opportunities;

- Develop a strategy for day trading;

- Open an account for trading on the real market;

- Make transactions and get profit!

Day trading is a risky activity that involves your active participation in trading, involvement and concentration. If you want to become a successful day trader, you will have to cultivate discipline, attentiveness, and also study technical analysis well. And the best platform for day trading in Malaysia will help you with this - open a demo account today and try for free in practice what day trading is.