Best strategy for long term trading

What is a trading strategy

Many business coaches advise making a plan of action to achieve a specific goal. Because it is clear and saves time and nerves. Similarly, it is in investing. Here, too, you need your own trading strategy.

Trading strategy is a system of rules to which a trader obeys in the process of trading on financial markets. This is a plan of action according to which the trader acts in each specific situation. A trading strategy must clearly answer the question: why has the investor taken a particular step and what will this step, lead to.

Following a trading strategy enables a trader to make stable profits in the financial markets and become a professional in this field. If you do not have a clear plan, you are more likely to turn your trading into chaos, lose your capital and be disappointed in investing forever. It is trading strategy and discipline that allow you to become a successful trader and multiply your savings. It is these components that ensure reliability and peace of mind in investing.

Why do you need a trading strategy?

First of all, a trading strategy is needed to make decisions quickly and correctly. Very often inexperienced traders forget about the importance of planning and start working without their own strategy. There appears uncertainty in the correctness of their actions, which, in turn, does not affect the trading results in the best way. It was proven a long time ago that it's impossible to make money on financial markets without a systematic approach. And this must be remembered!

Also, you should not forget that markets change over time. And to be successful a trader must watch these changes, fix them, analyze his trading, look for strategy weaknesses, make something new. Trading strategy must be periodically updated, adjusted to the current circumstances. It must be adapted to changing conditions. Having a clear-cut but at the same time flexible trading system, a trader can trade calmly and confidently.

You must first develop the right strategy before investing your money in the stock market.

Types of trading strategies

According to the time a trade is held open, all trading strategies can be divided into:

- short-term;

- medium-term;

- long term.

Short-term trades are open for a very small period of time - from a few seconds to a week. Medium-term deals are kept open from two weeks to several months. Long term trades, in turn, cover a duration of one year or more.

Those engaged in short-term trading are usually technical analysts. Technical analysts study market movements based on recent price trends and try to determine the reasons why price moves in a certain way. When they see that there are no significant reasons for the movements, they examine the deeper factors affecting price. They look for trends that show up as temporary price increases before they turn around and fall again.

Liquidity is the ability of an asset to turn quickly into money without losing value.

The liquidity of any item is the ability to sell it quickly at (or close to) the market price. The easier it is to exchange a thing for money, the more liquid it is considered. The higher the liquidity, the better the future movement will be. The best indicator of stock liquidity is considered to be the volume of trading on the stock in a day: the higher the volume of trading, the higher the liquidity.

Long term trading strategy

A trading system consists of certain components. They can be divided into three main blocks:

- entry into positions;

- exiting a position;

- position management.

Modern trading systems can open, maintain and close several positions simultaneously.

Various technical indicators are most often used in the position entry block, and fundamental analysis data can also be used. In the simplest trading strategy, a trade entry can be based on the signal of just one technical indicator. In this case, it is extremely important to choose it correctly, as well as set the appropriate parameters. To do this, you can use the parameter optimization method.

If everything is chosen correctly, it is possible to get quality entries. A quality entry allows you to take a significant portion of the price movement with minimal drawdown. If you were able to set up a quality trading signal to enter a trade, then do not expect there to be many such signals. You need to find the optimum ratio between the quality of signals and their quantity.

The quality of the signal to exit the trade is determined by what percentage of the trend was taken in the trade. An unsuccessful exit from the position reduces the quality of signals for market entry to zero. Only together good entry and good exit from positions determine a positive result.

Perhaps the most important and complex element of a strategy of long term trading is the position management unit. First of all, it is necessary to choose the optimal size of positions, which allows revealing the market advantage of the trading strategy as much as possible. Any long term strategy has its own individual optimal deal size. In the simplest case, a fixed amount in dollar terms is set, for example, for one position. Or, a certain percentage of the portfolio can be set aside for the position. But this is a more complicated variant.

There are many different options for position management. But it is worth remembering that you should start testing a trading strategy on the suitability of a simple long term trading strategy. And gradually move on to more complex ones.

The best long term trading strategy

Trading occurs in financial markets with specific trends and patterns. There are certain levels that indicate a turning point or trend. One of the best long term trading strategies is the trend following strategy. This system works best in financial markets with well-defined trends and price patterns. As a rule, trend movements do not occur often. In spite of that, their amplitude allows making good profit. Therefore, it is extremely important for a trader not to miss such a trend movement.

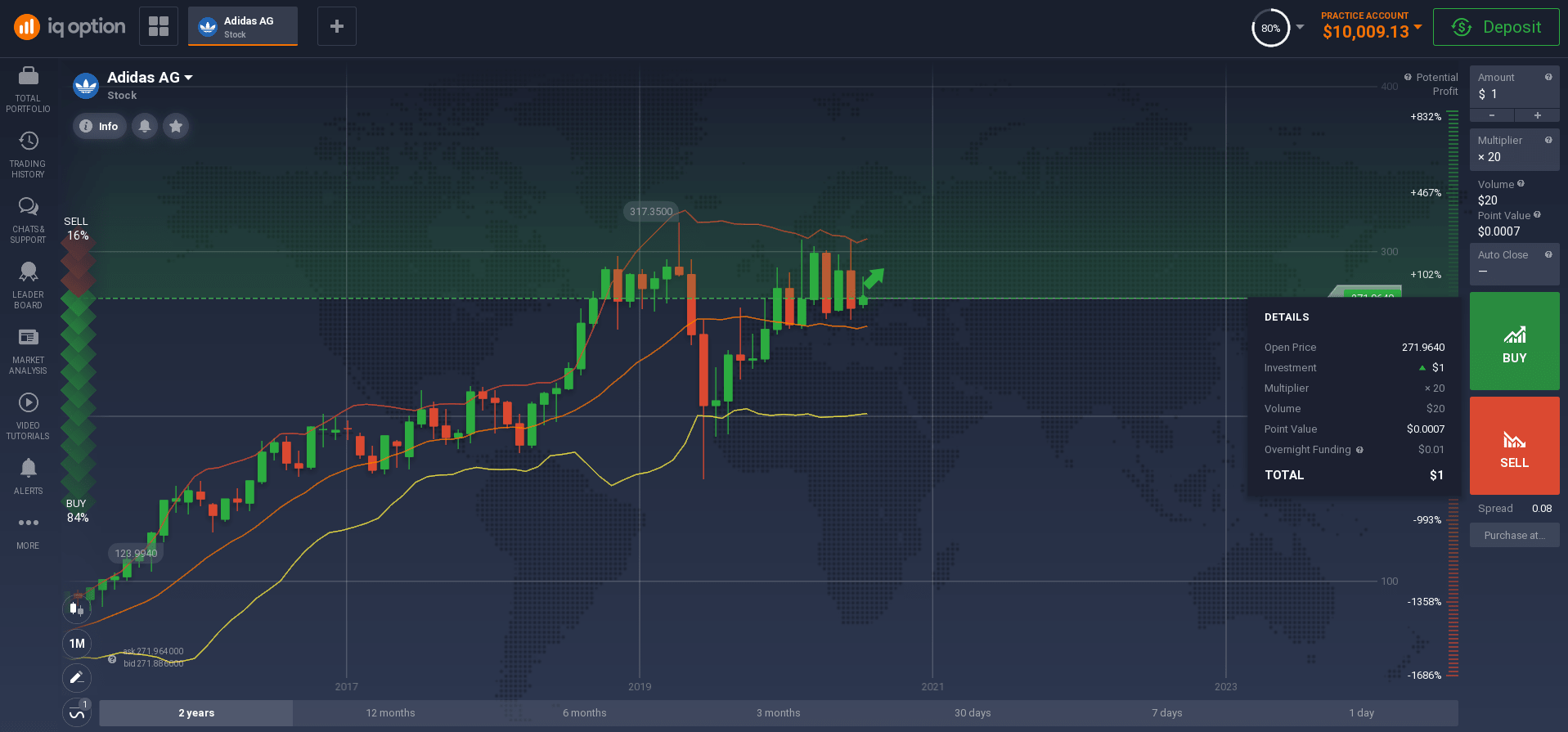

You can use a moving average indicator to determine the trend. Despite the fact that the moving average lags somewhat behind the price movement, it has one significant advantage. The moving average is an average indicator of the price for a given period of time.

It is worth to analyze the trading strategy behavior on different instruments. Considering that the system is trending, then the trading instruments should have sufficient volatility.

Volatility is the fluctuation of asset prices in the market over a selected period of time. It can be high or low. It depends on the gap between the maximum and minimum values of assets.

The index is measured as a percentage or absolute value. Volatility is taken for a certain period of time: a day, a week, a month, a year. Daily period is used by traders on short deals, weekly and monthly - on long deals. Volatility allows to make forecasts for the market behavior.

High volatility fluctuations are a good opportunity to make profit. But it is better to enter the market beforehand, when quotations are calm and there is calmness on the chart. Then there is a chance to test the market, get into the flow and make a profit.

This is not to say that volatility is good or bad. It is only one of the tools of market life, which can help to make a profit.

It is also necessary to pay attention to such tools as stop-loss and take-profit. These are some of the basic tools of position management.

Stop-loss is used to control the amount of risk. It limits possible losses if the price goes against the trader's direction.

The size of the stop-loss is the amount you feel comfortable losing in the market for a possible profit. You have to be prepared for a stop loss to trigger. It shouldn't affect your emotional state or make you off-balance in any way. Controlling losses without a stop loss is very difficult. Stop-loss helps control the amount of loss on each particular trade, and minimizes the loss of the entire deposit.

If a stop-loss is triggered, it means you were wrong in your analysis, because the situation is not developing the way you planned, and your forecast does not match the market trend.

So, stop-losses help you keep your losses under control, relieving you from emotional stress. And they also show that the analysis of the market situation has been done incorrectly.

Take-profit is a pending order to close a position after the price reaches the set level. It limits the profit and ensures that profits will not be missed, even if the price only "touches" the target level for a second. The investor determines the price at which the broker will automatically sell the assets.

Take-profit allows you to give the trade a system and does not let emotions (greed and the hope that the price will keep going in the right direction) prevent the trader from making the intended profit. Take-profit, at the very least, allows for a guaranteed closure of a trade "in the plus".

At first sight, such profit limitation seems strange. But there are cases when take-profit makes things right. Just like a stop-loss, this limiter helps when an investor does not have a lot of time to keep track of a stock's movement, waiting for more gains.

In addition, a take profit can protect against force majeure, technical malfunctions, and misjudging the market situation.

How to use a long term trading strategy in Malaysia

The best strategy for long term trading depends on several factors, including risk tolerance and capital availability. If you are new to the stock market, you should focus on developing a long term portfolio using conservative investment strategies. As you develop your portfolio, you should also monitor your returns and drawdowns to determine how to best dispose of each part of your portfolio. Long term investors often use systematic or fictitious trading strategies to minimize losses without making trades that could negatively affect their other assets.

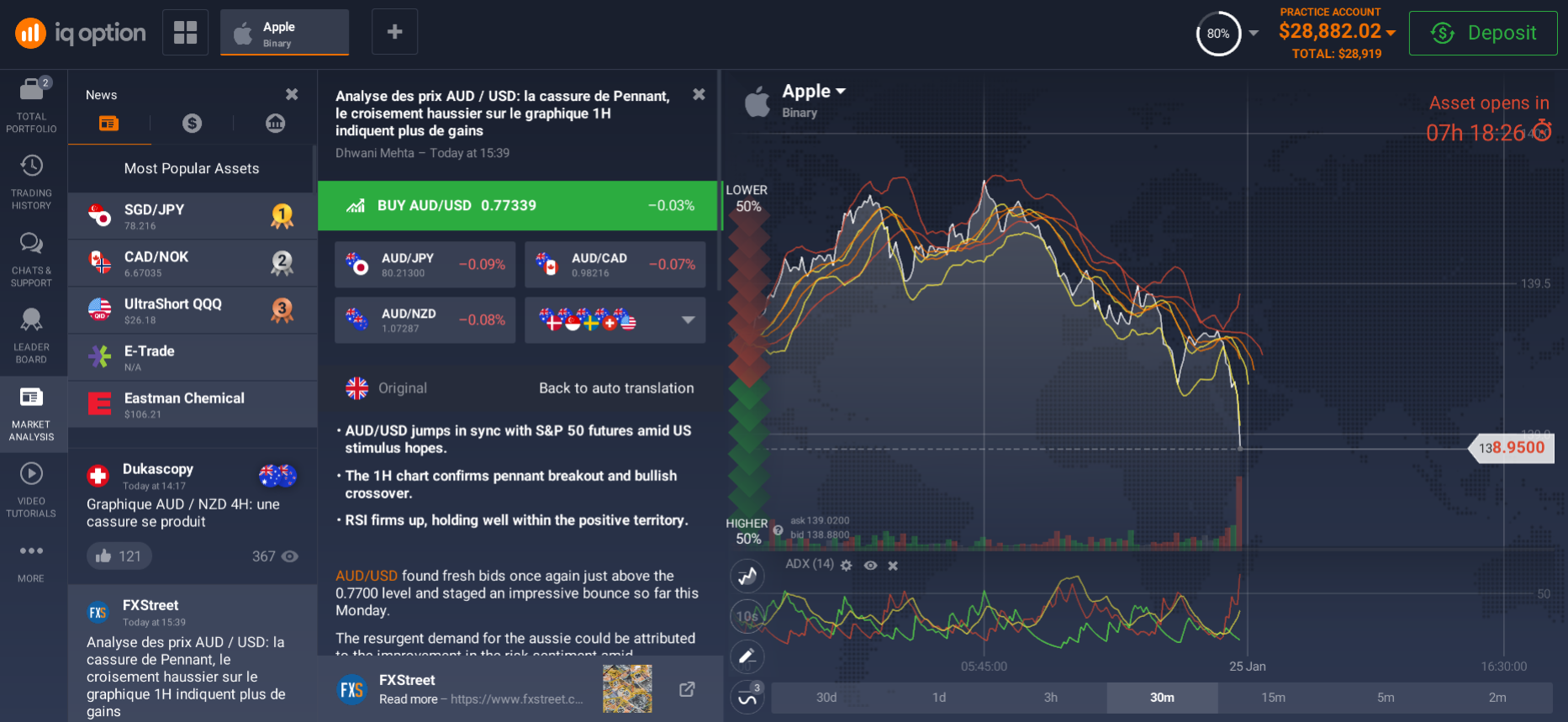

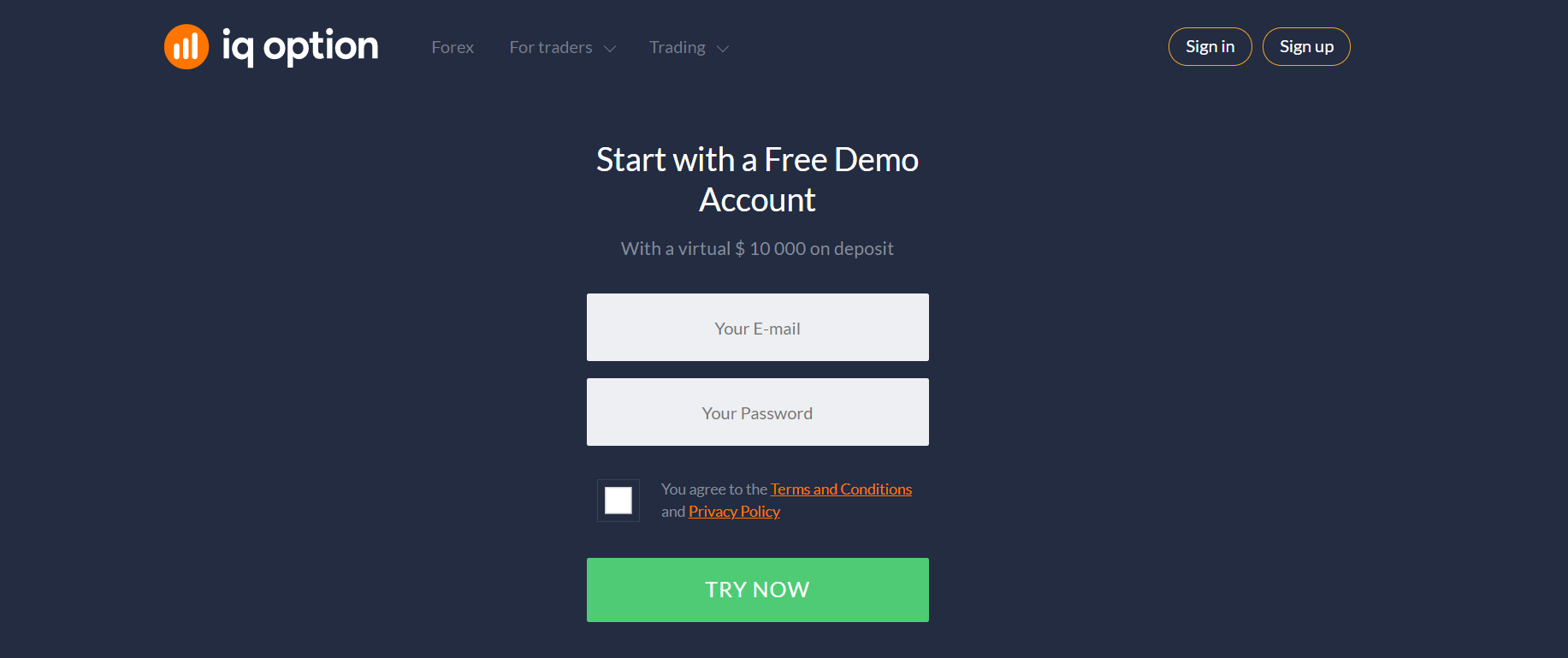

The easiest way to test your trading strategy long term is to use the services of an online trading platform.

The online investment platform is a program for the possibility of investing via the Internet, which can be used on different gadgets and in different versions, the main condition is only access to the Internet.

You only need to complete a simple registration. If you want, you can install a special application on your smartphone, and then you can monitor your investments from any convenient location (Internet access is required).

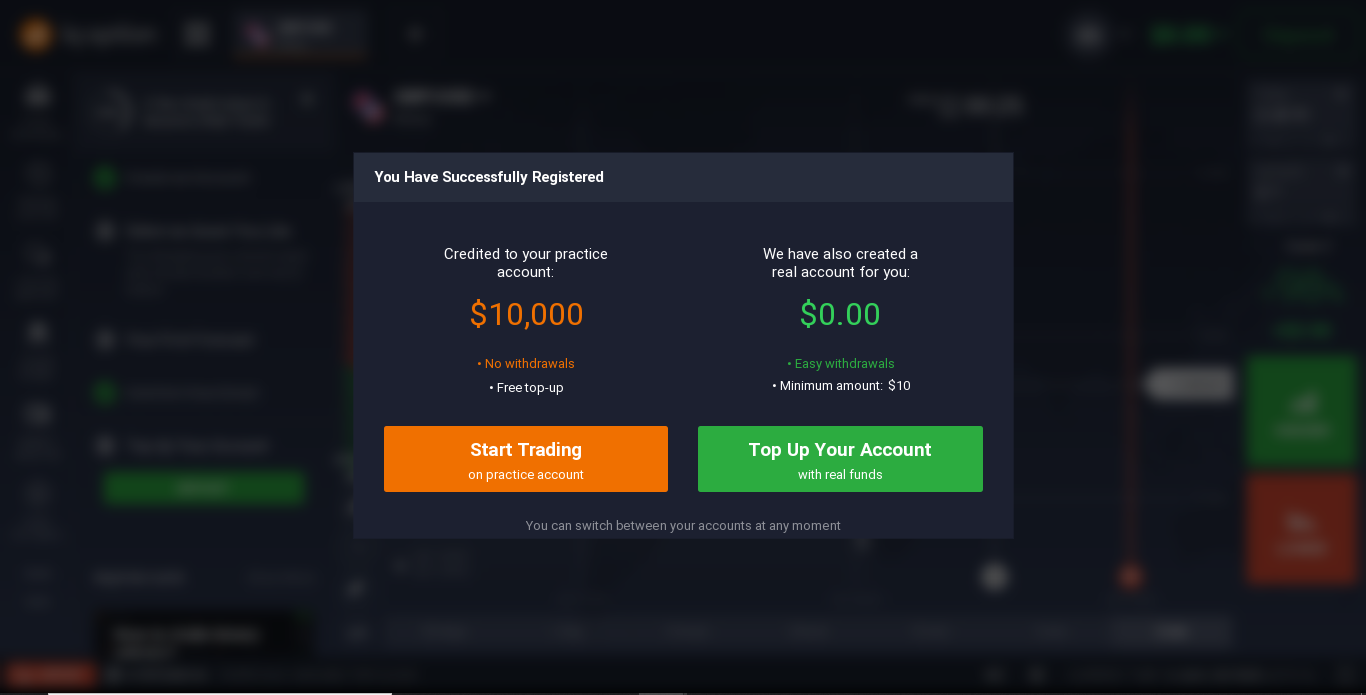

Immediately after registration, you will be offered to open a real trading account or a demo account.

The essence of the demo account is that you do not work with real money, but with virtual money. A demo account is a training simulator, where you can test the workability of your strategy long term trading.

But don't forget that your profits will also be virtual. If you want your investments to really work and earn, you should open a trading account. There is a mandatory minimum deposit. You can start with it, or you can start with a larger amount. The choice and decision is yours.

It is possible to sit in place and dream about large capitals indefinitely, or it is possible to start moving towards your dream today. Of course, using a trading long term strategy, you will not get rich quickly. But the result will be a reward for your patience and endurance. Try it! Everything is in your hands!